- How do the managers and owners of the SMEs in Pakistan perceive and apply FL in their business practices?

- What is the role of financial management methods in the long-term success of SMEs and the application of FL?

- Explore how does financial literacy of owners and managers supports the success of Pakistani SMEs.

Abstract

Small and medium enterprises' viability and sustainability are measured through financial literacy, with an emphasis on the mediating effect of methods of managing finances. Mostly SMEs across the sector struggle with sustainability due to a lack of sufficient financial knowledge. The tourism sector SMEs were chosen for this research. Such SMEs highly depend on intangible assets and the influence of financial literacy particularly in the off-season. Results reveal that FL has positively influenced SMEs' sustainability, both directly and indirectly, by improving financial management techniques, specifically, financial management variate partial mediation. The findings it is also highlight the necessity of focused financial literacy programs, and training sessions, and contribute to existing literature on SME growth by indicating how financial literacy can increase firm sustainability in underdeveloped nations.

Keywords

Financial Literacy, SME Sustainability, Financial Management, Structural Equation Modeling, Entrepreneurship Development

Introduction

The impact of economic growth is often seen because of the development of small businesses across the world both in developed and under-developing economies. In developing economies, small and medium enterprises (SMEs) are often seen to have an impact on economic growth, innovation, and job creation (OECD, 2023), while financial management issues are a major factor in business failure (Babajide et al 2021). SMEs still encounter significant challenges in achieving long-term sustainability. Financial literacy has been revealed as a capability that influences the ability of firms or managers to make sound decisions related to financial management and allocate resources effectively, and efficiently to deal with financial complexities in a competent manner (Lusardi & Mitchell, 2014; Murendo & Mutsonziwa 2016). Additionally, financial management practices establish a significant operational link between financial literacy and SME performance. A strong financial management system can convert financial knowledge into tangible and marketable outcomes through budgeting, forecasting, and financial analysis (Morshed, A. 2020; McMahon, 2001). Without effective financial management, even financially literate, they may fail to sustain and grow their businesses.

However, despite the increasing scholarly attention, gaps remain in understanding the mechanisms through which financial literacy translates into sustainable SME performance, particularly in developing economies where formal financial education opportunities are limited (Utomo, Cahyaningrum, & Kaujan, 2021). Moreover, prior research has often overlooked the mediating role of financial management practices, focusing instead on direct effects.

Against this backdrop, the current research seeks to determine how financial literacy affects the long-term viability of small and medium-sized businesses with a particular emphasis on the mediating role of financial management practices. By addressing this gap, the study provides theoretical contributions to the entrepreneurship and finance literature and offers practical insights for policymakers, development agencies, and SME owners seeking to foster resilience and long-term success.

To investigate the long-term assistance of FL for SMEs, with the mediation effect of various financial management methods.

The study's research questions are:

This research is aimed at:

Assess the mediator function of financial management in connecting FL Sustainability in the SMEs.

Review of Related Literature:

Financial Literacy and Sustainability in SMEs

Financial literacy is a major contributor influencing small business viability and sustainability. To comprehend and instrument the financial perceptions abilities like saving, budgeting, debt management, investing, and sensible spending strategies is known as financial literacy. It empowers organizations to plan and sustain their growth, make informed financial decisions, and allocate resources effectively. Furthermore, financial management techniques create an operational connection between financial literacy and SME performance. For instance, Ye & Kulathunga (2019) found that higher FL significantly improves financial planning and access to credit, both of which are major contributors to SME sustainability. Likewise, Mireku, Appiah, & Agana (2023) showed that SMEs with financially literate owners demonstrate better financial management techniques and more flexibility to economic risk increasing their long-term sustainability. Financial literacy becomes expressly important in developing countries where formal financial education prospects are sometimes limited. Gora and Dahiya (2022) claim that one of the main reasons for SME failures in developing countries is insufficient financial literacy. Consequently, enhancing financial literacy not only helps in growth but also generates a strategic barrier to organizational sustainability.

Financial Management Practices as a Mediator

Planning, organizing, directing, and managing financial activities, including resource acquisition and utilization are all parts of financial management. (McMahon, 2001). Effective financial management for SMEs includes sound budgeting, cash flow management, financial forecasting, and record-keeping which are key factors to ensure operational efficiency and sustainability. A strong theoretical foundation suggests that financial literacy improves financial management practices, leading to stronger stability (Fatoki & Oni, 2014). Entrepreneurs with higher financial literacy anticipate effective control over financial matters, monitor expenses, and maintain financial records, which contribute to better decision-making and business resilience. Empirical studies support this mediation framework. For example, Zada, Yukun, and Zada (2021) revealed that SMEs with better financial management practices had higher rates of profitability, business continuity, and market expansion. Furthermore, Dakare and Okon (2021) found that the connection between financial literacy and business accomplishments is partially due to practices in financial management, indicating that having financial knowledge alone is not sufficient without practicing it.

Thus, financial management practices serve as a thoughtful operational mechanism through which financial literacy translates into tangible sustainability outcomes for SMEs.

Conceptual Framework Development

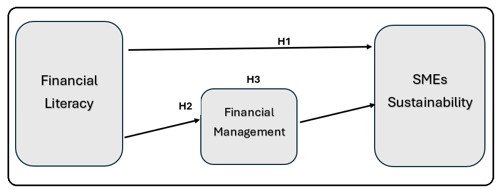

Financial literacy is conceptualized as an intangible resource that gives a firm a competitive edge when it is successfully used through sound financial management practices, based on the resource-based perspective (RBV) of the business (Putra et al., 2021, Barney, 1991, Wernerfelt, 1984). This study posits that FL poses both the effects on sustainability of SMEs directly and indirectly, with financial management methods playing a key role as a mediating mechanism, according to this theoretical framework.

Figure 1

Cite this article

-

APA : Amjad-ur-Rehman., Javed, A., & Yasir, M. (2025). Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices. Global Management Sciences Review, X(II), 18-26. https://doi.org/10.31703/gmsr.2025(X-II).03

-

CHICAGO : Amjad-ur-Rehman, , Assad Javed, and Muhammad Yasir. 2025. "Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices." Global Management Sciences Review, X (II): 18-26 doi: 10.31703/gmsr.2025(X-II).03

-

HARVARD : AMJAD-UR-REHMAN., JAVED, A. & YASIR, M. 2025. Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices. Global Management Sciences Review, X, 18-26.

-

MHRA : Amjad-ur-Rehman, , Assad Javed, and Muhammad Yasir. 2025. "Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices." Global Management Sciences Review, X: 18-26

-

MLA : Amjad-ur-Rehman, , Assad Javed, and Muhammad Yasir. "Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices." Global Management Sciences Review, X.II (2025): 18-26 Print.

-

OXFORD : Amjad-ur-Rehman, , Javed, Assad, and Yasir, Muhammad (2025), "Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices", Global Management Sciences Review, X (II), 18-26

-

TURABIAN : Amjad-ur-Rehman, , Assad Javed, and Muhammad Yasir. "Impact of Financial Literacy on the Sustainability of Small and Medium Enterprises, Mediating Effect of Financial Management Practices." Global Management Sciences Review X, no. II (2025): 18-26. https://doi.org/10.31703/gmsr.2025(X-II).03